They raise your cars and truck insurance prices as a hedge against this enhanced danger. Statistics show that any case will raise the typical expense of car insurance from 3% to 32% over the following 3 to five years. Simply put, ensure that the claim is worth the problem and sunken prices of automobile insurance premiums in the future.

In some circumstances, this enhancement to your car insurance coverage ensures that your prices won't increase for a case if you remain in a crash. Most usual kinds of cars and truck insurance coverage discount rates Also if you're a reasonably safe driver, you can still save even a lot more on your average cars and truck insurance costs by taking benefit of discount rates provided by car insurance providers.

This isn't just to show gratitude, however also since military participants often tend to present much less risk than other motorists. Safe driver price cuts: One more way to decrease your typical cars and truck insurance coverage expenses is by completing an eligible safety course every few years. By doing so, your insurance firm regards you a much more accountable motorist, lowering your threat as well as premium while doing so.

car cheaper car insurance insurance companies auto insurance

car cheaper car insurance insurance companies auto insurance

This suggests that if you preserve a B-average or better, you'll obtain a tiny price cut off your insurance costs. Ways to decrease your vehicle insurance costs Vehicle drivers that check all the boxes for better automobile insurance prices do not have actually to be pleased with a "good sufficient" rate. A fantastic driving document, good credit report, as well as other factors may give you reduced ordinary vehicle insurance policy costs, but you can conserve even more by complying with a couple of pointers. car insurance.

About Average Cost Of Car Insurance For April 2022 - Bankrate

The ordinary cars and truck insurance costs per year is $611 for the minimal responsibility automobile insurance. How much should you pay for complete coverage car insurance? In addition to where you live, your driving record, and your kind of coverage, automobile insurance policy business use a few other metrics to establish your auto insurance policy prices - cheapest car insurance.

At what age is vehicle insurance coverage cheapest? For both guys and also females, cars and truck insurance coverage is generally at its cheapest when you are around the age of 60.

That's what makes Jerry your biggest ally in the search for the very best automobile insurance policy rates - laws.

The 6-Second Trick For Aflac - America's Most Recognized Supplemental Insurance ...

Having the ideal details in hand can make it much easier to obtain a precise car insurance coverage quote. cheap car. You'll wish to have: Your motorist's permit number Your vehicle identification number (VIN) The physical address where your car will certainly be kept You might likewise want to do a little research study on the sorts of coverages readily available to you.

The average yearly expense of auto insurance in the united state was $1,057 in 2018, according to the current data offered in a report from the National Organization of Insurance Policy Commissioners. Understanding that fact will not necessarily aid you figure out just how much you will certainly be paying for your very own insurance coverage.

risks liability cheapest insurers

risks liability cheapest insurers

To better recognize what you must be paying for automobile insurance, it's ideal to find out about the method companies establish their rates. Keep reviewing for an introduction of the most typical factors, as well as how you can make a couple of additional savings. Computing Ordinary Yearly Auto Insurance Cost There are a lot of factors that enter into establishing your automobile insurance coverage price.

Below are some crucial aspects that affect the typical price of car insurance policy in America.: Males are usually related to as riskier drivers than women. The statistics show that females have less DUI occurrences than guys, as well as less accidents. auto. When women do get in a crash, it's statistically much less most likely to be a significant mishap.

Unknown Facts About Average Car Insurance Costs In 2021 - Ramseysolutions.com

Something much less apparent is at play here, too; if your state mandates specific standards for vehicle insurance policy that are more stringent than others, you're likely to pay more money. credit. Michigan, for example, calls for locals to have limitless lifetime individual injury security (PIP) for accident-related medical expenditures as a part of their vehicle insurance.

The 2nd the very least expensive state was Maine, complied with by Iowa, South Dakota, and also Idaho.: If you are using your car as an actual taxi or driving for a rideshare service, you will certainly have to pay even more for insurance coverage, and also you could require to spend for a different sort of insurance policy altogether - vehicle insurance.

, just how often you utilize your vehicle, why you use your auto, as well as where you park all impact your premiums. If you drive a lot more typically, you're subjected to the dangers of the road much more frequently.

low-cost auto insurance credit score insure low cost auto

low-cost auto insurance credit score insure low cost auto

Setting up monitoring software application on your lorry could help lower your premiums when you have a less-than-perfect history.: That very streamlined sporting activities cars and truck you've always https://how-does-citi-credit-card-rental-car-insurance-work.fra1.digitaloceanspaces.com desired? It's not just going to cost you the sticker cost: driving an useful auto makes you riskier to guarantee.

Top Guidelines Of The States Where Motorists Pay The Most For Auto Insurance

Insurance coverage premiums additionally account for the general safety and security of an automobile and the average cost of repair work. If you're looking to conserve on insurance policy, purchase a minivan, a reasonable sedan, or an SUV.

You obtain what you pay forif you're in a crash, you'll probably be glad you really did not select this as a location to stretch a dollar and save on. On the various other hand, if you never need to make a claim, you'll have taken the added savings without repercussion.

cheap car insurance vehicle vehicle insurance low cost

cheap car insurance vehicle vehicle insurance low cost

You currently understand that not all coverage degrees are developed equivalent, yet up until you head out as well as see what's available, you will never recognize whether you're obtaining the ideal bargain for the quantity of insurance coverage you want - auto insurance.: Are you a straight-A student? Active service in the military? An AAA member? These are just a few of the top qualities that could make you qualified for a discount on your insurance costs. vehicle.

Preserving the minimum amount of insurance coverage your state calls for will certainly permit you to drive legally, and it'll set you back less than full protection. However it may not provide sufficient defense if you remain in a mishap or your lorry is harmed by one more covered event. Curious concerning how the average cost for minimal protection stacks up against the cost of complete coverage? According to Insurify.

The 9-Second Trick For Average Car Insurance Costs In Texas - Smartfinancial

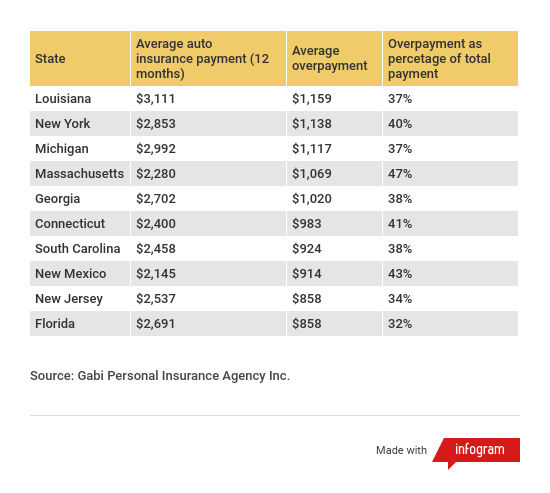

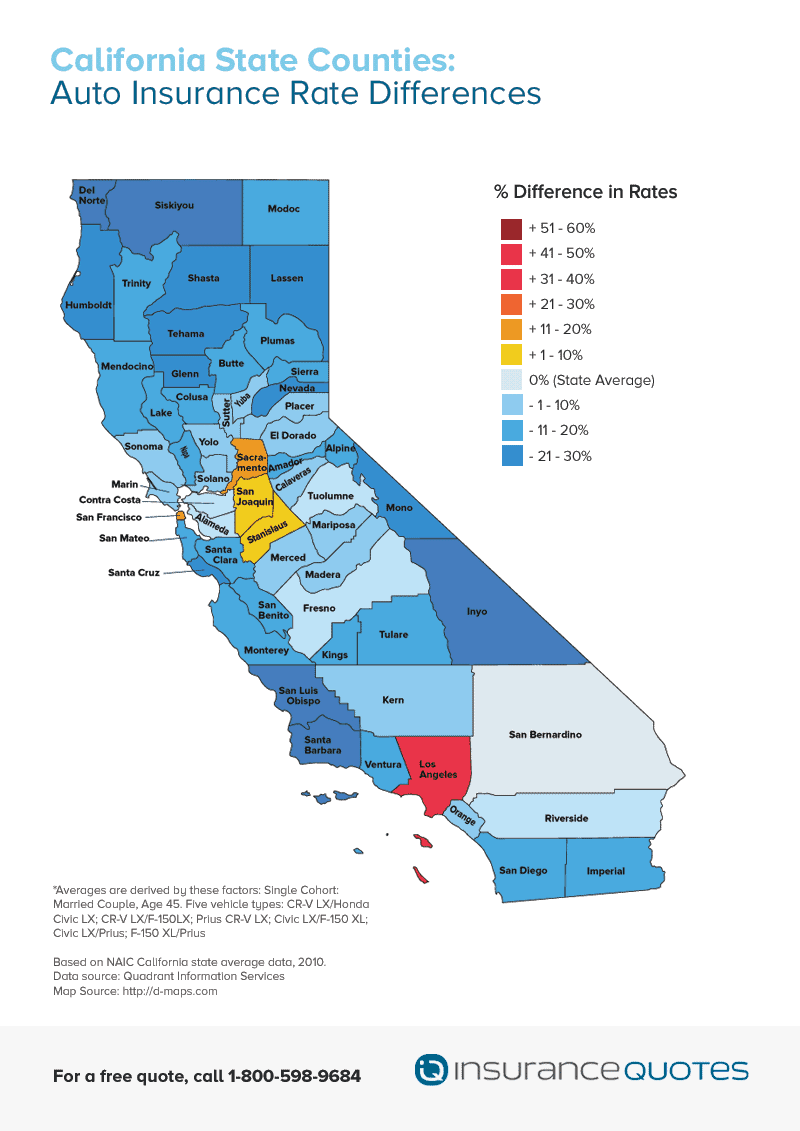

Yet the only way to know exactly just how much you'll pay is to look around and also get quotes from insurers. Among the variables insurance providers use to figure out rates is place. People that reside in locations with greater theft rates, accidents, and also all-natural calamities generally pay more for insurance coverage. And also since insurance regulations as well as minimum protection demands differ from state to state, states with greater minimum demands normally have higher typical insurance policy prices.

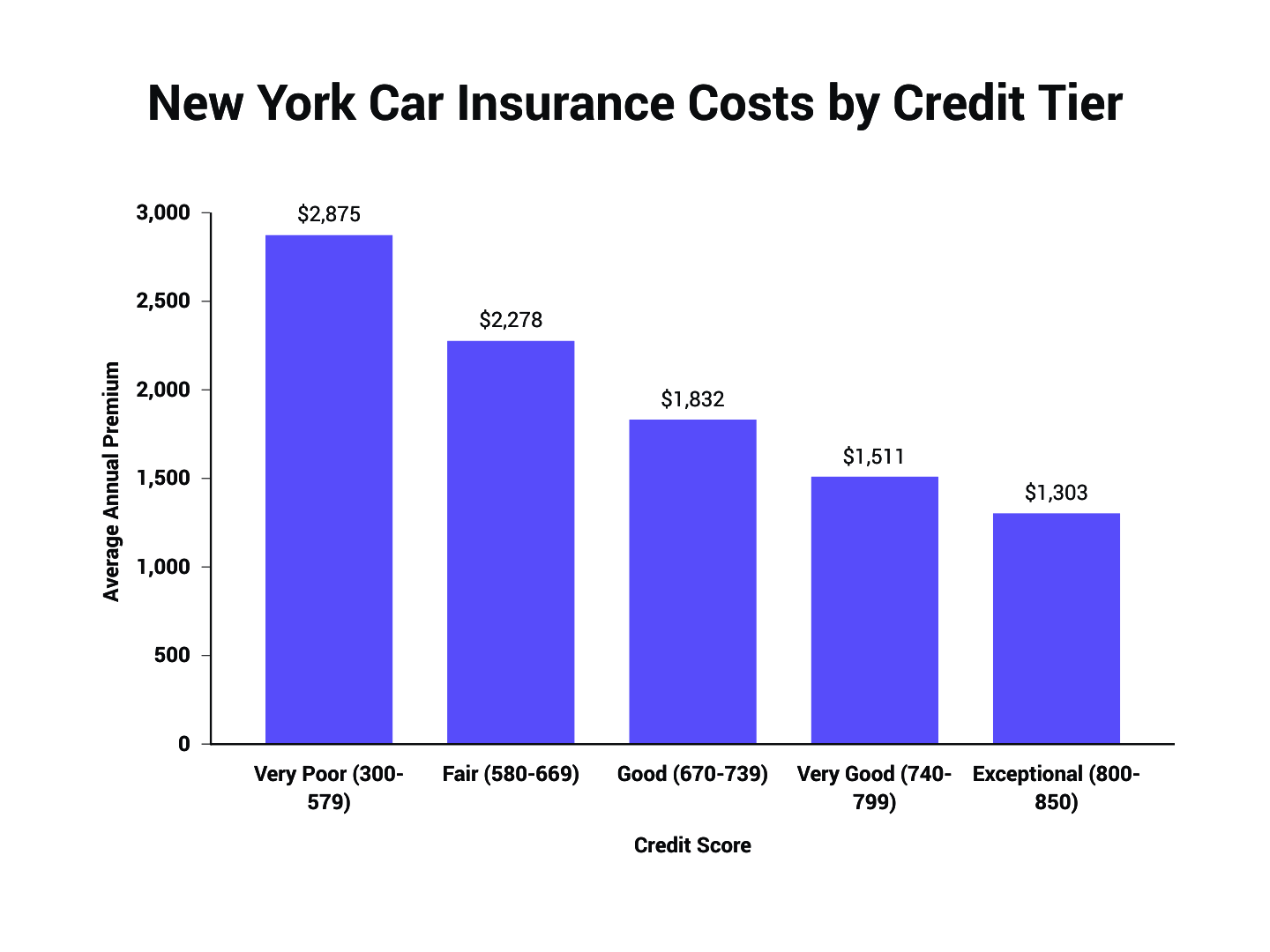

Most but not all states allow insurer to use credit scores when establishing rates. Generally, candidates with lower scores are more most likely to file a claim, so they typically pay more for insurance than motorists with greater credit report. If your driving record consists of crashes, speeding tickets, Drunk drivings, or other offenses, anticipate to pay a higher premium. cheapest car insurance.

Cars with greater price usually cost more to insure. Drivers under the age of 25 pay greater prices because of their absence of experience and raised accident danger. Male under the age of 25 are typically priced quote greater prices than ladies of the exact same age. However the void diminishes as they age, and also ladies may pay somewhat much more as they get older.

Due to the fact that insurance coverage firms have a tendency to pay more insurance claims in risky areas, rates are generally higher. Celebrating a marriage usually leads to reduced insurance coverage costs. Getting appropriate protection might not be inexpensive, yet there are methods to get a price cut on your car insurance policy. Here are five typical price cuts you might get approved for.

Some Ideas on Auto Insurance Revealed - How Many Us Drivers Don't ... You Need To Know

If you have your house as opposed to leasing it, some insurance firms will provide you a discount on your automobile insurance policy costs, even if your residence is insured through one more company. Besides New Hampshire as well as Virginia, every state in the country calls for vehicle drivers to maintain a minimum quantity of responsibility protection to drive lawfully.

cheapest car accident vehicle insurance risks

cheapest car accident vehicle insurance risks

It might be appealing to stick with the minimal limitations your state requires to reduce your premium, but you might be putting yourself in danger. State minimums are notoriously low as well as could leave you without appropriate protection if you remain in a significant accident. Many professionals advise keeping enough protection to protect your possessions. prices.

It might not provide sufficient protection if you're in a mishap or your car is damaged by another covered incident. Curious regarding just how the average rate for minimal protection stacks up against the price of full protection?

But the only way to recognize precisely just how much you'll pay is to search and also get quotes from insurers. Among the elements insurance providers utilize to establish prices is place. Individuals that reside in locations with higher theft rates, accidents, and all-natural calamities usually pay even more for insurance coverage. As well as considering that insurance policy regulations as well as minimal coverage requirements differ from one state to another, states with higher minimum needs normally have higher typical insurance costs.

The Buzz on How Many Us Drivers Don't Understand Their Policies?

Many however not all states permit insurer to make use of credit report when establishing prices. As a whole, candidates with reduced ratings are more likely to sue, so they commonly pay much more for insurance coverage than drivers with greater credit rating. If your driving record includes crashes, speeding tickets, DUIs, or other infractions, expect to pay a greater costs.

Vehicles with greater cost normally set you back even more to guarantee. Vehicle drivers under the age of 25 pay higher rates due to their lack of experience and also enhanced crash threat. Guy under the age of 25 are commonly priced quote higher rates than women of the exact same age. vehicle insurance. But the void reduces as they age, as well as ladies might pay a little a lot more as they get older.

Due to the fact that insurance companies often tend to pay more cases in risky areas, rates are normally higher. Getting ample coverage might not be economical, yet there are means to get a price cut on your cars and truck insurance coverage.

If you have your home rather than renting it, some insurance companies will give you a discount on your automobile insurance coverage costs, even if your home is guaranteed through another company. Apart From New Hampshire as well as Virginia, every state in the country calls for chauffeurs to preserve a minimum quantity of obligation insurance coverage to drive legally (perks).

Getting My Farmers Insurance: Insurance Quotes For Home, Auto, & Life To Work

It might be tempting to stick with the minimal restrictions your state requires to conserve on your premium, but you can be placing on your own in danger. State minimums are notoriously low as well as can leave you without adequate security if you're in a serious accident. Many experts suggest preserving enough coverage to secure your properties (car).